Account information

Looking for information regarding your B2B Bank accounts? Bookmark this page for up-to-date information.

B2B Bank Chequing Account

It's time to stop paying a monthly account fee2 and earn interest on your daily balance with the B2B Bank Chequing Account.

Saves money

- No monthly account fee2

- No minimum balance required

Rewarding

Earn interest on your daily account balance

Convenient

An easy to manage online banking experience

Do more with your B2B Bank Chequing Account

Account features

- Deposits and withdrawals

- Bill payments

- Transfer money

INTERAC®†

e-Transfer

Free to send and receive money using INTERAC e‑Transfer.

THE EXCHANGE®† Network

Access to over 3,500

surcharge-free ATMs in every province and territory

in Canada.

General Information

B2B Bank works with your financial professional to offer you financial products to meet your individual needs, while Laurentian Bank offers products and services directly to clients.

Both B2B Bank and Laurentian Bank of Canada are part of the Laurentian Bank Financial Group.

* Laurentian Bank Financial Group (LBCFG) is a diversified financial services provider whose mission is to help customers improve their financial health. Laurentian Bank of Canada, its subsidiaries and its entities are collectively referred to as Laurentian Bank Financial Group.

You can access your accounts anytime, anywhere through online banking (onlinebanking.b2bbank.com), using THE EXCHANGE Network ATMs (chequing account only) and by contacting Client Services at 1‑866‑334‑4434 Monday to Friday, 8 a.m. ET to 8 p.m. ET.

To access a banking session activity, you must use an Internet navigator equipped with a 128-bit encryption system. Most Internet browsers meet this security standard (e.g. Internet Explorer 10, Mozilla Firefox 10, Chrome, Safari, etc.). Please ensure that your preferred browser version meets this standard.

Yes, B2B Bank adheres to the principles adopted by the Canadian Bankers Association with respect to the protection of personal information. In addition, it uses the most secure encryption techniques presently available to ensure the confidential nature of the information it exchanges with you. However, complete confidentiality in the transmission of data is not always possible over the Internet and privacy cannot be ensured. Neither B2B Bank nor its affiliates will be responsible for any damages you may suffer if you transmit confidential or sensitive information to us and that information subsequently becomes public through no fault of ours.

Yes, you can access your online banking account by visiting our mobile-friendly website at onlinebanking.b2bbank.com.

The applicable rate is paid on every dollar in the account. Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account. For current interest rates, visit b2bbank.com/rates.

The applicable tier rate is paid on every dollar in the account. Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account. For current interest rates, visit b2bbank.com/rates.

No, you cannot download your tax receipts online. All tax receipts including, T5s and RL-3s, will be mailed on Wednesday, February 28, 2024. Quebec residents will receive T5s and RL-3s in separate envelopes.

T5 Tax receipts are issued to clients who have earned interest equal to or more than $50. All tax receipts will be mailed out on February 28, 2024. If you do not received your receipt you may request a duplicate to be faxed or mailed to you.

To request a duplicated copy of your tax receipt, please contact Client Services at 1-866-334-4434 Monday to Friday from 8:00 a.m. to 10:00 p.m. and weekends from 9:00 a.m. to 5:00 p.m. ET.

Account Functionality

Before you can transfer funds into your new B2B Bank Account, you need to link B2B Bank Account to your account from another financial institution.

- Go to B2B Bank Online Banking and select “Linked Accounts” from the navigation bar at the side.

- Input the information for the account that you would like to link.

- Within 48 hours, you will see 2 small deposits from B2B Bank in the account you’ve linked (at your other financial institution).

- Once you’ve received these deposits, return to the “Linked Accounts” page and enter the 2 amounts to complete the account link. The 2 small deposits are valid for 10 days after you begin the account link process.

You can change your password following the below steps:

- From the “top left menu icon”, select “My Profile”.

- Under the “Change Credentials” tab, answer the security question. Once you have correctly answered this, we will email you a “verification code/secret code”.

- Enter the online temporary password and you will be prompted to create your new password.

To update your contact information, please contact Client Services at 1‑866‑334‑4434.

Existing linked accounts held at another Canadian financial institution were automatically transferred over; however, please re-enter any scheduled or re-occurring dates and amounts, or make alternative payment arrangements.

- From the main navigation, select “Manage Payees”.

- Select “Add a new payee” at the bottom of the page.

- Search for the company by name.

- Select the company whose bill payment you would like to set up.

- Fill in the required payment details.

- Confirm and save the payee details.

Existing bill payees were automatically transferred over; however, please re-enter any scheduled or re-occurring payment dates and amounts, or make alternative payment arrangements.

The following self-service features will be available with your new B2B Bank Online Banking:

- Account maintenance & overview

- Linking an external account held another Canadian Financial Institution

- Internal transfers between B2B Bank accounts (excluding Mortgages & GICs)

- Bill payments

- Secure message centre

- Balance and transaction inquiries

- Cheques

- VOID cheque image

Link External Account

- Select "Link Account" from “top left navigation icon” and input the following external banking information:

- Account number

- Bank Transit

- Institution Number

- Nickname

- Click "Submit"

- Once you have received your micro-deposit confirmation (after 48 hours)

- Select “Link account”

- Input two micro-deposits received in external account in

- Deposit 1

- Deposit 2

- Click "Confirm"

Once the micro deposits have been confirmed the account will appear under Linked Accounts. Please note that pending micro deposits must be confirmed prior to linking additional accounts. Unconfirmed micro deposits will expire after 10 days. Maximum of 4 IIFT accounts can be linked. If you would like to remove a linked account, please contact B2B Bank at 1‑866‑334‑4434.

IIFTs are usually processed within 5 business days.

You can deposit money into your chequing account by linking the account with your other financial institution, through an internal account transfer or by depositing a cheque at an EXCHANGE® Network ATM.

You can deposit money into your High Interest Savings Account (HISA) by linking the account with your other financial institution or by transferring money from your B2B Bank Chequing Account.

You can contact us at 1‑866‑334‑4434 or send us a message using the ‘Transactional inquiry’ function via the secure message centre when you are logged into the new B2B Bank Online Banking. You may be required to provide additional information on the transaction.

(Example: Bell, MasterCard etc.)

- Select "Manage Payees" from “top left menu icon”

- Select "Add a new payee"

- Input company name in field provided and click "Search"

- Select payee from search result

- Input payee account number in field provided, click "Overview details"

- Click "Confirm and save" to complete setup

Transactions made prior to the conversion will not be visible in your account overview; however, if you would like to receive a printed copy of your transaction history, please call 1‑866‑334‑4434.

There will be no charge for printed statements of previous transactions.

Real-time transactions submitted online cannot be cancelled. For future dated transactions, please call us at 1‑866‑334‑4434.

Transfer from Chequing to HISA account using the “Transfer” function

- From the homepage, select chequing product from which payment will be made

- Select "Transfers" tab

- Click on "Account" button

- Select "From HISA" from dropdown

- Amount

- Select when "Immediately"

- Select "Continue"

- Confirm transfer details

- Select "Transfer"

- Select "Download in PDF" (optional)

Transfer from HISA to Chequing account using “Quick transfer” function

- Select "Account" from "From Account" dropdown

- Select "HISA product"

- Select "Account" from "To Account" dropdown

- Select "Chequing"

- Input Amount

- Select "Transfer"

- Download and print confirmation (optional)

The “Quick transfer” function offers quick and easy access to one-time transactions for immediate processing from the home screen.

The “Transfer” function offers the same functionality of “Quick Transfer”, with the addition of the following:

- Ability to process one-time future payments;

- Ability to schedule recurring payments;

- Ability to add personal references to each transaction.

To send a transfer, click on the account you’d like to send from and click on the “Transfers” tab.

You can use the “VOID cheque image” and provide it to your external payee.

- Select "Void cheque" from side menu bar

- Select "Chequing account" from "Select account" dropdown (Transit No. and Inst. No. will auto populate)

- Select "Generate a void cheque"

- Select "Print or Save"

- Print void cheque

- Save void cheque

If the biller is not on the list, the payment cannot be processed online.

You can contact us at 1‑866‑334‑4434 or send us a message using the “General inquiry" function via the secure message centre when you are logged into the new B2B Bank Online Banking.

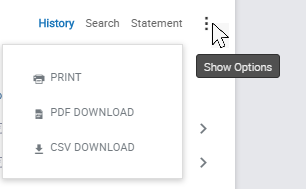

Yes. At the account overview, the transaction history will display the last 10 days of activity. The show options icon will allow you to print, download to PDF or CSV format.

The Search option will allow you to view/print/download older transactions by date range.

This feature will be available at a future date.

- High Interest Savings Account (HISA)

- GIC

- Investment Loans

- RSP Loans

- TFSA Loans

- Mortgages

- Home Equity Line of Credit (HELOC)

- Home Owners Kit (HOK)

Please contact us at 1‑866‑334‑4434 to close an account.

The NSF fee is $50 for the chequing account.

When receiving funds to your B2B Bank account, there is no limit on the amount per transaction. When sending funds from your B2B Bank account to your account at another financial institution, the limit is $50,000 per transaction. There is no limit on the number of inter-institution fund transfer transactions you can conduct per day for either the Chequing Account or HISA.

Yes.

Your B2B Bank Chequing Account and B2B Bank High Interest Savings Account requires a five business-day hold on incoming inter-institution fund transfers (IIFT), beginning the day after the date of deposit. This means that when you link another external bank account and initiate a transfer, the money can take up to five business days to show up in your B2B Bank Chequing Account as available funds.

This protects both you and the Bank from transfer errors or fraudulent activity.

Our hold policy is adjusted in the following circumstances:

Accruing interest: even if there is a hold on your funds, interest on the incoming transfer is paid as of the day the transfer is initiated. This means you will not lose out on interest during the hold period.

Direct deposits of your pay are not subject to the five-day hold.

®†INTERAC and INTERAC Debit are registered trademarks of Interac Corp. Used under license.

Why can’t I send an Interac e-Transfer?

Effective December 8, 2023, Interac® e-Transfer functionality will no longer be available. You can view your account documentation, including the new Chequing Fee Schedule at b2bbank.com/accountinformation.

If you have any pending Interac e-Transfers

Please accept them or request the recipients to accept them no later than December 7, 2023. After this date:

- you can no longer accept Interac e-Transfers;

- all outgoing pending Interac e-Transfers will be automatically cancelled, and funds from those will be returned to your account.

How to continue transferring funds

You can continue to transfer funds between your B2B Bank digital chequing account to another financial institution via an electronic funds transfer (EFT) following these easy steps:

- Go to online banking and select “Linked Accounts” from the navigation bar at the side.

- Input the information for the account that you would like to link.

- Within 48 hours, you will see 2 small deposits from us in the account you’ve linked (at your other financial institution).

- Once you’ve received these deposits, return to the “Linked Accounts” page and enter the two amounts to complete the account link. The two small deposits are valid for 10 days after you begin the account link process.

Debit Card

You can contact us at 1‑866‑334‑4434.

Visit b2bbank.com/find-an-atm to find an ATM near you.

For all other inquiries, call 1‑866‑334‑4434.

The Accel®† debit payments network includes more than 500,000 ATMs. Thanks to THE EXCHANGE Network, you can use your card at Accel ATMs to withdraw surcharge-free from some, but not all Accel ATMs in the U.S.* Use the Accel ATM locator to find a surcharge-free ATM at accelnetwork.com. We recommend that you choose a four-digit PIN if you often travel abroad.

* Additional surcharge fees may be applied to transactions, depending on the Accel ATM used.

Your B2B Bank debit card allows you to withdraw a daily maximum of $1,500 CAD from automated banking machines and a $3,000 CAD daily maximum for purchases made at point‑of‑sale.

If you’d like a debit card to use with your account, send us a secure message or contact Client Services at 1-866-334-4434.

Statements

You will continue to receive your paper statements at no charge and you will also be able to view your transaction history online.

Yes, you may still log in to ePost using your current user id and password to view previous statements.

Your monthly online statements are available on the first day of each month. You can access your statements by following these instructions.

You can contact us at 1‑866‑334‑4434 or send us a message using the “General inquiry" function via the secure message centre, when you are logged into the new B2B Bank Online Banking.

To view a list of all the fees associated with your accounts, visit b2bbank.com/fees.

Offers

Interest rates are per annum. Interest is calculated daily on the closing balance and paid monthly on the last day of the month into the account. All rates are subject to change at any time without prior notice.

Signing up

If you are a current B2B Bank customer and want to gain access to your online banking account, please contact Client Services at 1‑866‑334‑4434 for assistance.

In accordance with legislation, we are required to ask for your SIN for any interest-bearing account for tax. We may need to provide you a T5 Statement of Investment Income so you can report your interest income when filing your taxes.

You can find your B2B Bank account number by either logging in to your B2B Bank online banking account by visiting onlinebanking.b2bbank.com or on your monthly account statement.

You will need to have an B2B Bank HISA or Chequing Account in order to register for an B2B Bank GIC. If you don’t have one already, sign up today at onlinebanking.b2bbank.com

B2B Bank clients can select “Buy GIC” link from the hamburger menu within their online banking.

Yes. The CDIC protects eligible deposits up to a maximum of $100,000 (principal and interest combined) per depositor per insured category. No need to sign up – B2B Bank is a CDIC member so coverage is free and automatic.

The minimum investment is $100 and the maximum is $500,000.

Credit Verification/Equifax

Equifax is a credit reporting agency that uses the information they have on consumers to calculate their credit scores. B2B Bank uses Equifax’s services to verify a client’s identity and credit background.

Equifax uses the information it has on file to confirm credit verification information ensuring that the account details are being entered by you and no other person. To help prevent someone from opening a fraudulent account under your name, Equifax may ask you questions about your credit history through our system, the details of which only you would be privy to.

No. The information from Equifax is only used to perform a “soft” credit verification to confirm your identity.

We verify your identity immediately during the online account sign-up process.

If you are experiencing issues validating your identity through Equifax, you may have inaccuracies or incomplete information on your Equifax credit file:

- You are entitled to request a free copy of your Equifax credit report by calling 1-800-465-7166. Select option 1 for service in English, and then select option 1 again to access your credit report. In order to verify your identity, you will need your full legal name, two pieces of government-issued identification and current mailing address. It will take 5-10 business days for your report to arrive in the mail.

- Review your credit file to identify any inaccuracies. Verify the formatting of your personal information, especially your name and address. Your birth date and SIN will be redacted in this credit file.

- If there are errors on your credit file, call 1-800-465-7166 and select option 3 to speak with a representative who can help you correct your information. You may be asked to provide Equifax with proof of the correct information by mail or fax.

- Once the information has been verified, wait two weeks for the new information to be applied to the Equifax system before re-applying for your B2B Bank digital account.

- Try to sign up again and ensure you enter all information exactly as it appears on your credit file.

CRA Direct Deposit

Direct deposit allows you to access your money faster and more conveniently. It is reliable and your payment will always be deposited on time in the bank account that you supply when you enrol.

You only need to register once, and all your future payments and refunds from the CRA will automatically be deposited into your chosen account.

If you are eligible for the Canada Emergency Response Benefit, we encourage you to sign up for direct deposit as soon as possible to receive your benefit payments on time.

- To set up CRA Direct Deposit, you need to have a B2B Bank Chequing or B2B Bank High Interest Savings Account for at least 30 days. If you don’t have an account with us, you can sign up here.

- All Canadians who have a valid Social Insurance Number (SIN) and have filed at least one tax return are eligible to sign up easily online.

Canada Emergency Response Benefit applications are open now. Please refer to the CRA’s Canada Emergency Response Benefit webpage for more details.

The CRA aims to process direct deposit enrolment or information updates in one to two business days, however given current circumstances you may experience longer than usual processing times.

You can get updates on the status of your payment or enrolment by contacting the CRA directly at 1-800-959-8281.

Your new registration will override any previous direct deposit information on file with CRA. Once you complete your registration, all future CRA payments will be deposited into the account you registered most recently.

You can expect to receive direct deposit payments within five business days of the scheduled payment date.

If you are fully registered for CRA’s My Account, you can verify your direct deposit and payment information through their online self-service portal.

You may need to repay a CERB payment because:

- You applied for EI or CERB on or after March 15th, 2020 through Service Canada and later applied for the CERB through CRA.

- You applied for a 4-week CERB payment through the CRA and later realized you were not eligible to receive the benefit payment.

If you mistakenly applied for the CERB through both Service Canada and the CRA, you may have received two payments of $2000 for your first eligibility period. If this is the case, the CRA will send you a letter with instructions on how you can repay one of these $2000 payments, without interest or penalties.

To return or repay a CERB payment, you can do so by either:

- Returning the cheque, if you have not yet cashed it to:

Public Services and Procurement Canada

Imaging and Receiver General Operations Directorate

P.O. Box 2000 Matane, Québec

G4W 4N5

- Sending a payment to the CRA if you are unable to return the original cheque or you received a direct deposit.

Payments should be made out to “Receiver General for Canada”.

Include the following with your payment:

- That it is a “Repayment of CERB”

- Your Social Insurance Number (SIN) or your Temporary Tax Number (TTN)

Mail your payment to:

Revenue Processing

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 0C1

Under normal circumstances (for payments by direct deposit), banks can return the full amount electronically to the Receiver General by RIV using the Return Reason Code 922 (Customer Initiated Return). However, all RG-related functions are currently on hold due to COVID-19.

The Financial Consumer Protection Framework

The Federal government has introduced a new Financial Consumer Protection Framework (the “Framework”) to the Bank Act to better protect customers of banking services. The new regulations came into force on June 30, 2022. Laurentian Bank has enhanced its consumer protection measures to comply with the Framework.

The provisions of the Framework are meant to protect all consumers. These provisions may be relevant to the accounts and services you have with us. Some of our existing account agreements have been updated to reflect the new Framework.

- e-Alerts for personal deposit and credit accounts

If you have provided us with your email address, you will begin receiving electronic alerts (“e-Alerts”). You will receive an alert when the available credit in your personal line(s) of credit or your home equity line(s) of credit is less than $100 or the balance in your personal deposit account(s) is less than $100. These alerts are intended to help you better manage your money and avoid potential fees.

- Complaint resolution

We have updated our complaint handling process to improve how we address your concerns. The process is outlined in our updated Complaint Resolution Brochure, which will be at your branch, or on our website in the coming weeks.

The Complaint Report of the Head of Complaint Resolution can be found here:

2022 Complaint Report (from June 30, 2022 to October 31, 2022)

If you wish to set an amount for your alert, contact us at 1‑800‑263-8349.

If you do not wish to receive alerts, choose “unsubscribe” in the e-Alerts email.

If you wish to receive e-Alerts, log in to your online account and update your email information, or call 1-800-263-8349.

NOTE: If your account is held jointly, only one limit may be set per account. Only one person will receive alerts or be able to opt out of receiving them.

You can learn about protections for bank customers from the Financial Consumer Agency of Canada by visiting canada.ca/en/financial-consumer-agency/services/banking/rights-new-protections.html.

Contact us

Call

1‑866‑334‑4434

Mail or courier

B2B Bank

199 Bay Street, Suite 600

PO Box 279 STN Commerce Court

Toronto ON M5L 0A2